LL.M. Taxation (LL.M. Steuern)

Taxation Master at ISM - First distance learning, then tax advisor!

Companies have to deal with various tax issues on a daily basis, which makes a masters in taxation online an increasingly valuable qualification. For this, they need experts who responsibly take care of all tax matters. In addition to the corporate context, these tax experts can also become self-employed as consultants. The ISM Distance Learning Programme Taxation offers you exactly this qualification:

In the ISM Distance Learning Taxation program, you will graduate with a Master of Laws degree and at the same time have the opportunity to prepare for the tax advisor exam during your studies.

We have designed the program in such a way that the modules already include essential content that will be examined as part of the tax advisor exam. In the case modules, for example, you can apply what you have learned to concrete cases from practice or prepare for the tax consultant exam with exams and exercises.

Master’s degree in LL.M. Taxation at a Glance

Master’s degree LL.M. Taxation – Your Career Path to the Future

Study at one of the leading business schools, backed by over 35 years of experience and consistently top-ranked in prestigious university rankings.

Join the only distance learning programme in the German-speaking world offered by an AACSB-accredited university — a globally recognised mark of excellence among top-tier business schools.

Benefit from one-to-one support through dedicated study coaches and tutors, along with cutting-edge learning materials designed specifically for distance education.

Overview of the Master’s degree LL.M. Taxation

Normal study period

four semesters

Start of semester

at any time

Admission requirement

- Bachelor’s degree with at least 50 ECTS credits in business sciences

- At least 10 ECTS credits in quantitative or methodological subjects

- English proficiency (B2)

Qualification

Master of Laws

Language

german

Study locations

100% online

Practice

Live seminars

Tuition fees

Different cost models to choose from

Recognition of prior studies

recognition of prior studies is possible upon application. Our study coaches will advise you on this.

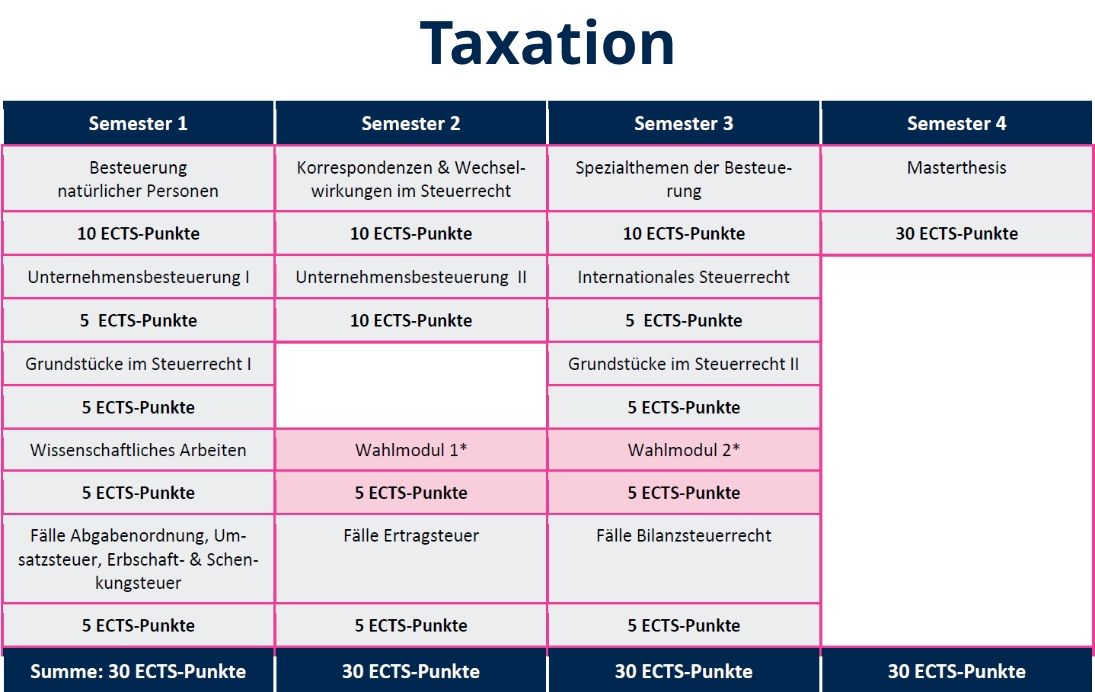

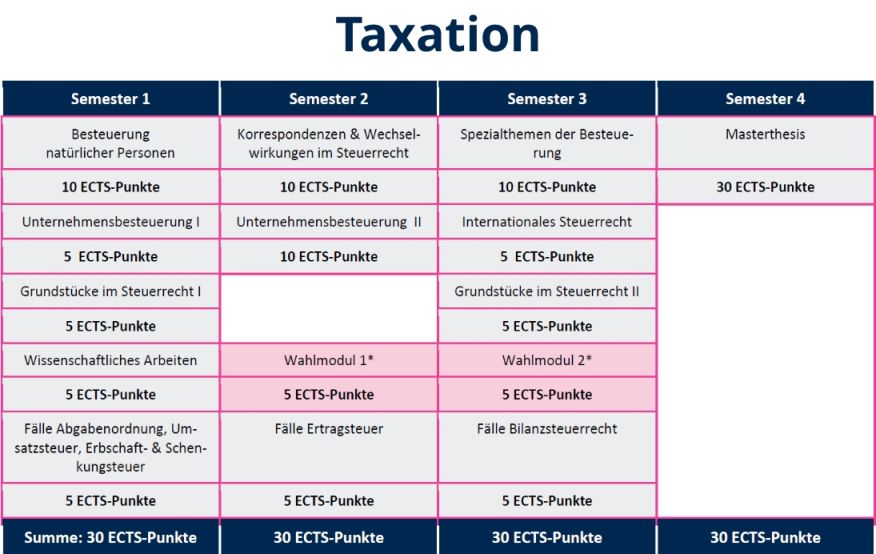

This is what the Master’s degree LL.M. Taxation looks like

The master’s in taxation online at ISM provides the essential legal and practical expertise needed to navigate national and international tax systems. As part of leading online master’s in taxation programmes, you’ll study core subjects such as individual and corporate taxation, property tax law, and the legal frameworks governing compliance and cross-border regulations. Modules in scientific research methods strengthen your ability to analyse tax data and produce well-founded legal assessments.

As you progress, you’ll explore correspondence tax law, international taxation, specialised areas of taxation, and practical case studies in income tax, VAT, inheritance and gift tax, and balance sheet tax law. Elective modules let you tailor the programme to your interests within the field. Throughout your studies, you’ll refine analytical, problem-solving, and decision-making skills through applied casework and research. With ISM’s flexible structure, this degree—one of the most practice-oriented online tax master’s programmes—can be completed full-time or part-time to suit your professional and personal commitments.

This curriculum provides a sample study plan for the full-time option. Would you like to see the part-time curricula as well?

Overview – Costs for the Master’s degree LL.M. Taxation

Fulltime

- 4 – Semesters

- 30 – ECTS per Semester

- 690 € – Enrollment fee

- 14.970 € – Total price

(incl. two additional

semesters)

Part-Time

- 6 – Semesters

- 20 – ECTS per Semester

- 690 € – Enrollment fee

- 15.810 € – Total price

(incl. two additional

semesters)

-

Mon 16 MarchMeet a student: Master’s studies (EN)

Find out now in an initial consultation

Your Benefits in the Master’s degree LL.M. Taxation at ISM

The masters in taxation online forms the foundation for your career. If you decide to pursue a distance learning degree at ISM, you’ll benefit from numerous advantages that offer you maximum flexibility and a first-class education:

- Trial period during the first four weeks: You have the opportunity to test the concept of distance learning free of charge during the first four weeks. This allows you to make sure that a distance learning programme truly suits you.

- Study whenever and wherever you want: All learning materials are available to you digitally. Whether at your desk, on the go, or on the sofa – you decide how your studies fit into your daily life.

- Individual support: Our study coaches and support team are available to assist you at any time, to answer your questions and help ensure the success of your studies.

- Interactive exercises and exam preparation: Numerous practical assignments, flashcards, and mock exams help you prepare in the best possible way for your exams.

- Close contact with lecturers: Our experienced lecturers and tutors support you both academically and practically – so you always stay on top of things and reach your goals.

- 100% flexible exams: No travel required – all exams are included in the tuition fees and can be taken conveniently online.

- 2 free additional semesters: If you are unable to earn all the required credit points within the standard period of study (e.g. four semesters for full-time study), you can catch up on the missing coursework during two additional semesters free of charge. This offer applies to every study model.

Your Studies, Your Pace

Whether you choose a full-time programme or a part-time option alongside your job – with a distance learning programme at ISM, you can tailor your education to fit your personal circumstances. You remain fully in control of your time without having to compromise on a high-quality education.

Admission Requirements: Your Path to the Master’s degree LL.M. Taxation

Admission to ISM can be granted through several different paths.

The basis for enrolment is the official admission requirements set by our university. You will need a completed bachelor’s degree with at least 50 ECTS credits in the field of economics or business studies, including 10 ECTS credits in quantitative or methodological subjects. Any missing ECTS credits can be acquired through online bridging courses.

If you are unsure whether you meet the requirements, we are happy to advise you. Simply contact us by telephone or email – we will review your documents and provide you with reliable feedback regarding your individual chances of admission.

1. With A-levels or Advanced Technical College Certificate (Fachabitur)

Do you have the general higher education entrance qualification? Great! Your A-levels are recognised throughout Germany and grant you access to your desired degree programme, regardless of your final grades. You can also start directly with us if you hold a Fachabitur.

2. With a subject-specific higher education entrance qualification

You can get started straight away if your chosen degree programme matches the subject area of your higher education entrance qualification.

3. With an intermediate school-leaving qualification

Studying at ISM is also possible without A-levels! You can start with the following requirements:

• A completed commercial vocational training programme of at least two years and

• Three years of subsequent commercial work experience.

If your vocational training and work experience are not in the commercial field, we offer you the opportunity to take an entrance examination to demonstrate your ability to study.

4. Without an intermediate school-leaving qualification

Studying with us is also possible without an intermediate school-leaving qualification if you meet certain requirements: With a completed vocational training programme of at least two years and three years of work experience, you may begin your studies after successfully passing the entrance examination. However, this option requires a high level of commitment and initiative.

5. With a master craftsman qualification or comparable advanced training

A master craftsman’s certificate or an equivalent advanced qualification opens the door to our Bachelor's degree programmes – please get in touch with us, we will be happy to advise you!

Admission Requirements

Here you can find all the information on admission

Why Choose the Master LL.M. Taxation at ISM?

Maximum Flexibility

Study full-time or part-time – design your studies according to your individual needs.

Personalised Support

Your personal study coach will guide you throughout your programme. experienced tutors are available to help with subject-specific questions in each module.

Schedule a consultation

Renowned University

Over 35 years of experience and top positions in university rankings.

AACSB Accreditation

The only distance learning programme in the German-speaking world to hold this prestigious distinction.

Up-to-Date Learning Materials

All materials are newly developed and based on current real-world examples.

Practical Focus

Workshops and research projects provide a hands-on, practice-oriented education.

Future-Proof Career Field

With a master’s degree you become part of a highly sought-after, future-oriented professional field.

Scientifically Grounded

The distance learning programme is based on the latest scientific research in the field of distance education.

Personal Atmosphere

As a smaller, more personal university, we offer you close support and an individualised learning environment.

Still Have Questions? We're Here for You!

Our academic advisory team is always available to support you with any questions you may have and to help you find the best path into your studies.

Already have all the information you need?

Start now – your dream degree programme is waiting!

Recognition of Prior Learning for the Master’s degree LL.M. Taxation

Have you already started or completed a degree programme or pursued specific continuing education courses? As part of your application – or even in advance – we will review which of your prior achievements can be credited toward your studies at ISM. This allows you to shorten your study duration, reduce tuition fees, and focus directly on new learning content.

We can recognise the following types of prior learning:

- Academic credits from previous university studies (including master’s programmes)

- Further professional qualifications (e.g., Chamber of Industry and Commerce – IHK)

- Several years of relevant professional experience

Please send us the relevant certificates/proof along with a description of the learning content (e.g., module handbook, official curriculum plans) for evaluation.

Shape the future with the Master’s degree LL.M. Taxation

By completing the master’s degree in taxation via distance learning, you’ll gain the legal and analytical expertise required to navigate complex national and international tax systems. The programme provides a strong foundation in tax law, compliance, and corporate taxation, while fostering critical thinking and practical problem-solving skills. You’ll develop the ability to interpret legislation, evaluate financial structures, and develop tax strategies that support sustainable organisational decision-making. As with other specialised online qualifications, such as an LLM taxation online, this programme offers the flexibility to study from anywhere while enhancing your professional capabilities. As one of the leading online taxation degrees, it equips you to build a successful career in tax consultancy, corporate tax departments, or advisory roles within global organisations.

Your study programme Director for Master’s degree LL.M. Taxation (LL.M. Steuern)

Your study program director for

M.A. Sustainability Management

WP / StB Prof. Dr. Manfred Bolin

Master Taxation

Manfred Bolin heads the Department of Financial Reporting and Law at ISM and has been lecturing in the field of national and international accounting and taxation for over 25 years. He previously completed his doctorate on the topic of "Harmonisation of Accounting in the European Union" and was subsequently sent to Brussels by the Institut der Wirtschaftsprüfer in Deutschland e.V. (Institute of Public Auditors in Germany) as part of his work as a foreign consultant, among other things, for the follow-up negotiations regarding European accounting in the European Union. In order to pass the auditor's examination, Mr Bolin moved to an international auditing company where he rose from audit manager to partner. "The LL.M Taxation programme not only provides an overview of the legal foundations of German tax law, it also trains participants in its business and social implications. Especially in today's world where these effects on daily life, but also the effects of aggressive tax models are discussed, this knowledge is very valuable." Prof. Dr Manfred Bolin

FAQ for Master’s degree LL.M. Taxation

The tuition fees for the masters in taxation online at ISM vary depending on whether you choose the full-time model or one of the part-time routes. As with other online tax master’s programmes, all core services including digital study materials, virtual exams and academic support are included in the total cost. This means you can complete your degree without worrying about unexpected or additional fees.

Yes, the programme is officially accredited and recognised by established higher education authorities. Your qualification is valid for career opportunities in Germany and internationally, much like other reputable online master’s in taxation programmes. ISM also holds the prestigious AACSB accreditation, a distinction awarded to only around 6% of business schools worldwide. This underscores the high academic quality of the degree, which aligns with professional standards expected from advanced programmes such as an online LLM in Taxation.

The curriculum covers a wide spectrum of tax-related subjects, including individual and corporate taxation, VAT, property tax, balance sheet tax law, and inheritance and gift tax. You will also engage with international taxation, legal interpretation, and scientific research methods. As part of one of the leading online tax master’s programmes, these topics equip you with a strong analytical and practical foundation to address complex tax matters in both national and global contexts.

Your Master's Student Advisory Service

Marcella Brockerhoff

AACSB accreditation

Currently the only distance learning program in Germany with international AACSB accreditation

Accredited

State recognized